January 21, 2026

Top 10 Hotel PMS Alternatives to Cloudbeds & SiteMinder: 2026 Complete Comparison

Compare the top 10 hotel management software for 2026. Cloudbeds vs SiteMinder vs Oracle OPERA pricing, features & why independent hotels choose Revenue-as-a-Service over SaaS.

Explore the top 10 hotel management software options for 2026 with a detailed comparison of Cloudbeds, SiteMinder, and Oracle OPERA. Discover pricing, features, and why independent hotels are opting for Revenue-as-a-Service over traditional SaaS solutions.

For independent hotel owners, choosing the right property management system can feel like navigating a maze. You're bombarded with legacy giants like Oracle, connectivity specialists like SiteMinder, and modern all-in-one platforms like Cloudbeds.

But here's the problem: Most of these solutions follow the traditional SaaS (Software as a Service) model. They charge you a fixed monthly fee—whether your hotel is at 90% occupancy or sitting empty during low season. You get the software, but managing it, optimizing it, and extracting value from it? That's all on you.

The global hotel management software market is projected to reach $12.21 billion by 2032, growing at 11.87% annually[^1]. Yet according to industry surveys, 73% of independent hotels struggle to maximize the value from their PMS investments—not because the software is bad, but because they lack the dedicated revenue management expertise to use it effectively.

In 2026, a fundamentally different model is disrupting the industry: Revenue-as-a-Service (RaaS).

This comprehensive guide analyzes the Top 10 hotel management solutions across 7 critical dimensions—from all-in-one capabilities to pricing models—to help you make the right choice for your property.

🎯 Key Findings

- Traditional SaaS platforms (Cloudbeds, SiteMinder, Mews) charge $100-300+/month regardless of performance

- Enterprise solutions (Oracle OPERA) require $50K-500K+ implementation—impractical for independents

- Revenue-as-a-Service (RaaS) model eliminates fixed costs with performance-based pricing

- Hotels using RMS effectively see 5-20% RevPAR increases—but only with skilled management

- Southeast Asia hotel market growing rapidly with unique multilingual requirements

Table of Contents

- The Top 10 Contenders: Detailed Reviews

- Feature-by-Feature Comparison

- Cost & Business Model Analysis

- Master Comparison Table

- The Hidden Costs of SaaS Hotel Software

- Real-World Case Studies

- How to Choose the Right Solution

- Frequently Asked Questions

The Top 10 Contenders: Detailed Reviews

Before diving into feature-by-feature comparisons, let's examine each player—their strengths, weaknesses, and ideal use cases.

1. ZUZU Hospitality (The Revenue Partner)

Best for: Independent hotels (20-100 rooms) seeking revenue growth without hiring dedicated revenue management staff.

What makes ZUZU different: Unlike every other provider on this list, ZUZU operates as a "Service + Software" partner. We provide the complete tech stack (PMS, Channel Manager, Booking Engine, Revenue Management System), but we also provide the people—dedicated Revenue Managers who handle operations and pricing optimization for you.

Key Stats:

- Operates on performance-based pricing (you only pay when you earn revenue)

- Focuses on Southeast Asian markets with multilingual support (Thai, English, Bahasa, Vietnamese, Chinese)

- Average client sees 12-18% RevPAR increase in first year

Pros:

- ✅ "Done-For-You" solution – ZUZU's team actively manages your rates, inventory, and channel optimization

- ✅ Zero risk pricing model – No fixed monthly fees; you only pay a performance commission

- ✅ No upfront costs – No setup fees or implementation charges

- ✅ Active revenue management included – Real humans (not just algorithms) monitoring your competition daily

Cons:

- ❌ Not designed for large global chains with existing Revenue Directors (though we can customize our system for larger operations—contact us to discuss your requirements)

- ❌ Currently focused primarily on Asian markets including Southeast Asia, India, and New Zealand

- ❌ Hotels must be comfortable with a revenue-sharing model (though this typically provides better value than fixed monthly fees)

Pricing: Performance-based commission only (no fixed monthly fees)

Target Market: Independent hotels, boutique properties, and small regional chains (15-300 rooms) in Southeast Asia

2. Cloudbeds (The SaaS Leader)

Best for: Tech-savvy hotel operators with 10-50 rooms who can manage the system themselves.

Cloudbeds has become one of the most popular unified hospitality management platforms globally, trusted by over 20,000 properties. The platform is famous for its modern, intuitive interface and "one-login" concept that brings PMS, channel manager, and booking engine together[^2].

Key Stats:

- Founded 2012, ranked #1 PMS by Hotel Tech Report (2021-2025)

- Connects to 400+ distribution channels

- Pricing starts at ~$100-150/month for small properties[^3]

Pros:

- ✅ True all-in-one platform with seamless PMS-Channel Manager integration

- ✅ Modern, user-friendly interface that's easier to learn than legacy systems

- ✅ Massive marketplace of 400+ third-party integrations

- ✅ Strong customer reviews for ease of use

Cons:

- ❌ Strictly DIY (Do-It-Yourself) – If you don't know how to configure yield management rules, the system won't automatically optimize your revenue

- ❌ High fixed monthly costs regardless of occupancy performance

- ❌ Many users report pricing can become expensive when adding required modules

- ❌ Revenue management tools require expertise to use effectively

Pricing: $100-150/month starting price; scales with property size and features[^3]

Setup Costs: $500-2,000 typical

Target Market: Hostels, boutique hotels, and independent properties with tech-literate staff

3. SiteMinder (The Connectivity King)

Best for: Hotels that prioritize maximum OTA distribution reach above everything else.

SiteMinder is the global gold standard for channel management, voted #1 Channel Manager in the 2026 HotelTechAwards[^4]. Its core strength is connecting hotels to the widest possible range of booking sites worldwide.

Key Stats:

- Connects to 450+ global and niche OTAs

- Integrates with 350+ PMS systems

- Pricing starts at €56-85/month[^5]

Pros:

- ✅ Unmatched connectivity to 450+ booking channels including GDS

- ✅ Extremely stable, reliable platform with 99.9%+ uptime

- ✅ Strong presence in global markets

- ✅ Real-time synchronization prevents overbookings

Cons:

- ❌ While distribution is world-class, their PMS features (via Little Hotelier) feel basic compared to dedicated PMS providers

- ❌ Support can feel impersonal due to massive company scale

- ❌ Revenue management requires separate third-party tools

- ❌ Subscription costs add up across multiple properties

Pricing: €56-85/month starting; additional fees for PMS integrations and add-ons[^5]

Target Market: Any hotel size, but especially valuable for properties needing extensive global OTA coverage

4. Little Hotelier (The Small Property Specialist)

Best for: Small B&Bs, guesthouses, and motels under 20 rooms.

Powered by SiteMinder, Little Hotelier is an all-in-one solution designed specifically for small properties that need simplicity over sophistication.

Pros:

- ✅ Very easy to learn and use—minimal training required

- ✅ Includes SiteMinder's powerful channel manager built-in

- ✅ Affordable pricing for very small properties

- ✅ Good for operators without technical background

Cons:

- ❌ Limited feature depth—lacks tools for larger operations

- ❌ Missing complex housekeeping reports and corporate billing features

- ❌ Not scalable if your property grows beyond 20 rooms

- ❌ Basic revenue management capabilities

Pricing: ~$50-80/month

Target Market: B&Bs, guesthouses, small motels (5-20 rooms)

5. Mews (The Modern Tech Stack)

Best for: Forward-thinking hotel chains and design-conscious operators who prioritize guest experience automation.

Mews has gained attention for its "fintech" approach to hospitality, focusing heavily on automation features like self-check-in kiosks and mobile-first guest journeys.

Pros:

- ✅ Cutting-edge, beautiful interface

- ✅ Open API designed for developers and custom integrations

- ✅ Excellent for automating the entire guest experience

- ✅ Mobile-first design philosophy

Cons:

- ❌ Can be expensive and complex to implement properly

- ❌ Requires modern operational mindset—traditional hotels may find workflows too different

- ❌ Steeper learning curve than Cloudbeds

- ❌ Revenue management still requires manual configuration

Pricing: Mid-to-high range; custom quotes based on property needs

Target Market: Modern boutique chains, tech-forward independent hotels

6. RoomRaccoon (The Boutique Automator)

Best for: Independent boutique hotels wanting to maximize ancillary revenue through automated upselling.

An award-winning system that focuses on automating guest communication and increasing revenue per guest through strategic upsells.

Pros:

- ✅ Excellent automated email marketing and guest journey features

- ✅ Online check-in with built-in upsell opportunities (breakfast, upgrades, late checkout)

- ✅ AI-powered dynamic pricing with RaccoonRev Plus

- ✅ All-in-one platform designed for independents

Cons:

- ❌ Somewhat rigid workflows—less customizable than competitors

- ❌ Customer support primarily operates in European time zones

- ❌ Limited presence in Asian markets

- ❌ Smaller integration marketplace compared to Cloudbeds

Pricing: Mid-range; subscription-based

Target Market: Boutique hotels (10-50 rooms) focused on revenue per guest optimization

7. Hotelogix (The Cloud Veteran)

Best for: Mid-sized hotels in Asia looking for reliable, functional cloud PMS.

One of the earliest cloud PMS providers in Asia, Hotelogix offers solid operational functionality at reasonable prices.

Pros:

- ✅ Robust feature set covering front desk, housekeeping, and POS

- ✅ Good value for money compared to Western alternatives

- ✅ Strong presence in Asian markets

- ✅ Reliable and stable platform

Cons:

- ❌ User interface feels dated compared to Mews or Cloudbeds

- ❌ Revenue management features are rule-based, not AI-driven

- ❌ Integration ecosystem smaller than market leaders

- ❌ Mobile app functionality lags behind newer competitors

Pricing: Affordable; competitive in Asian markets

Target Market: Mid-sized hotels (30-80 rooms) in Asia-Pacific

8. eviivo (The Vacation Rental Manager)

Best for: Vacation rentals, Airbnb hosts, and multi-unit property managers.

Designed primarily to solve the "double booking" nightmare for hosts managing properties across Airbnb, Vrbo, Booking.com, and other vacation rental platforms.

Pros:

- ✅ Excellent calendar synchronization across vacation rental platforms

- ✅ Strong "Promo Manager" feature for special offers

- ✅ Solves multi-calendar headache effectively

- ✅ Good for hosts managing multiple properties

Cons:

- ❌ Not a true hotel PMS—lacks features for staffed front desk operations

- ❌ Missing shift management, corporate invoicing, and group booking tools

- ❌ Better suited for self-service properties than full-service hotels

- ❌ Limited integration with hotel-specific tools

Pricing: Scales with number of properties managed

Target Market: Vacation rentals, Airbnb hosts, serviced apartments

9. RMS Cloud (The Complex Powerhouse)

Best for: Holiday parks, campgrounds, and mixed-use resorts with diverse inventory types.

Originally from Australia, RMS is powerful software capable of handling complex inventory (cabins, powered campsites, hotel rooms, long-term stays).

Pros:

- ✅ Incredibly flexible booking chart—can handle non-standard inventory

- ✅ Ideal for properties that aren't traditional hotels

- ✅ Comprehensive feature set for complex operations

- ✅ Strong in Australian/NZ markets

Cons:

- ❌ Dense, complex interface with steep learning curve

- ❌ Configuration and staff training can take weeks or months

- ❌ Overkill for standard hotel operations

- ❌ User interface not as modern as cloud-native competitors

Pricing: Mid-to-high range

Target Market: Holiday parks, campgrounds, mixed-use resorts

10. Oracle Hospitality (OPERA Cloud) – The Enterprise Standard

Best for: Large luxury resorts, 5-star properties, and global hotel chains (200+ rooms).

The "grandfather" of hotel software. If you walk into a Marriott, Hilton, or Hyatt property, they're likely using Oracle OPERA[^6].

Key Stats:

- Selected by Hyatt, Accor, Rotana for their global PMS[^6]

- Powers thousands of luxury properties worldwide

- Custom enterprise pricing (not publicly disclosed)[^7]

Pros:

- ✅ Unmatched feature depth—can handle anything

- ✅ Handles thousands of rooms and complex multi-property operations

- ✅ Advanced conference management and group booking capabilities

- ✅ Enterprise-grade security and redundancy

- ✅ Proven track record with major global brands

Cons:

- ❌ Extremely expensive—setup costs range from $50,000 to $500,000+[^7]

- ❌ Interface often feels outdated and clunky compared to modern cloud tools

- ❌ Massive overkill for independent hotels under 100 rooms

- ❌ Requires dedicated IT staff and extensive training

- ❌ Implementation timelines of 3-12 months

Pricing: Custom enterprise pricing; typically $50K-500K+ implementation[^7]

Setup Time: 3-12 months

Target Market: Large luxury hotels, global chains, resorts (200+ rooms)

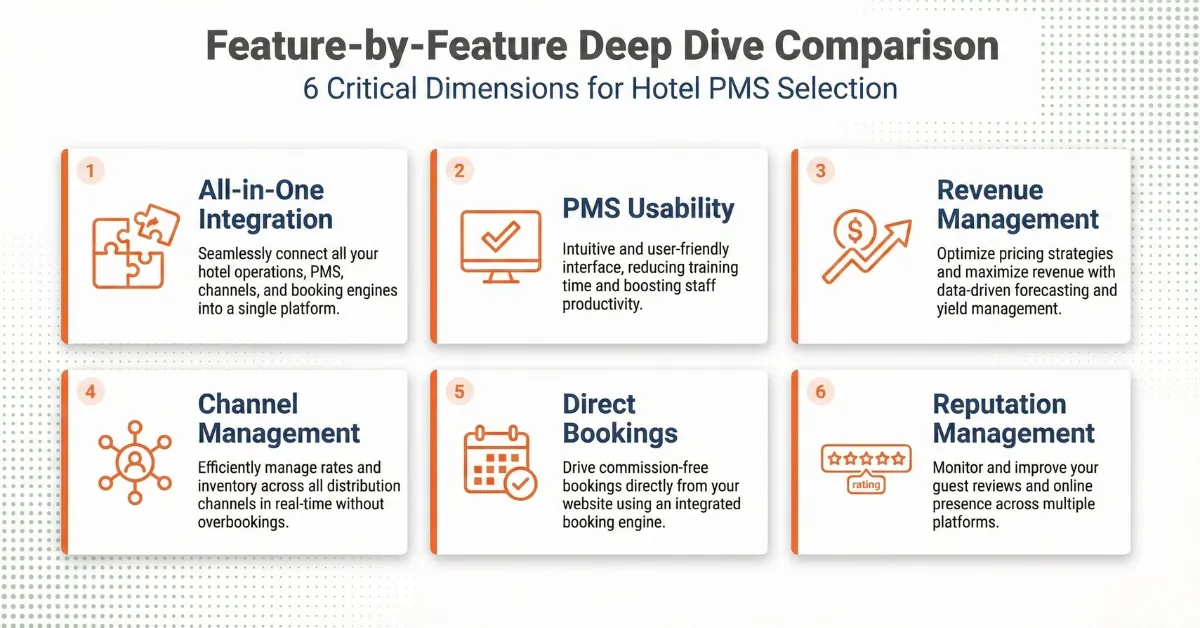

Feature-by-Feature Deep Dive

Now let's compare how these 10 solutions stack up across the dimensions that actually matter for independent hotels.

1. All-in-One Integration: Seamless vs. Fragmented

Most independent hotels want a single login for everything—no juggling between separate systems for PMS, channel management, and bookings.

The True "All-in-One" Platforms:

Cloudbeds, Mews, RoomRaccoon offer genuine unified platforms where PMS, Channel Manager, and Booking Engine communicate seamlessly. However, they're self-service—you must configure rate mappings, troubleshoot channel issues, and optimize settings yourself.

The ZUZU Approach:

ZUZU provides the same seamless "all-in-one" tech stack, but with a major difference: Managed Operations. We don't just give you the software—we handle the configuration, daily management, rate optimization, and troubleshooting. It's truly "all-in-one" including the human expertise.

The "Best-of-Breed" Approach:

SiteMinder excels at channel management but requires integration with separate PMS. Oracle OPERA offers comprehensive features but is so complex it requires dedicated IT teams to manage integrations.

Bottom Line: If you want all-in-one software you manage yourself → Cloudbeds or Mews. If you want all-in-one service managed for you → ZUZU.

2. PMS Usability: Simple vs. Powerful

The daily workhorse of your hotel operations needs to be fast, intuitive, and reliable.

Complexity Spectrum:

Complex/Enterprise (Oracle, RMS Cloud, Mews):

- Powerful but steep learning curve

- Require dedicated training programs

- Best for properties with IT managers

- Can take weeks for staff to master

Simple/DIY (Little Hotelier, eviivo):

- Very easy to learn—minimal training needed

- Great for 5-10 room properties

- Hit feature limitations at scale

- Lack depth for complex operations

Efficiency-Focused (ZUZU, Cloudbeds):

- Streamlined for independent hotel staff

- Mobile-friendly interfaces

- Staff can master in hours/days, not weeks

- Balance of simplicity and functionality

Winner for Independent Hotels: ZUZU and Cloudbeds offer the best balance—powerful enough for real hotel operations, simple enough for non-technical staff.

3. Revenue Management & Dynamic Pricing: The Revenue Driver

This is arguably the most critical feature for profitability—and where the biggest gap exists between solutions.

Rule-Based Tools (Cloudbeds, SiteMinder, Hotelogix):

These systems offer "Pricing Tools" or "Yield Rules" that you must configure yourself.

The Trap: You set static rules like "If occupancy > 80%, increase rate by 10%." This is reactive, not predictive. It requires you to:

- Constantly monitor your competition

- Understand market demand patterns

- Manually adjust rules as seasons change

- Interpret data and make pricing decisions daily

According to industry research, hotels using RMS tools typically see 5-20% RevPAR increases—but only if actively managed by skilled revenue managers[^8].

AI-Powered Tools (Mews, RoomRaccoon RaccoonRev Plus):

These use machine learning to suggest dynamic pricing based on demand signals, competitor rates, and historical patterns. Better than rules, but still require human oversight and approval.

Active Human Management (ZUZU):

ZUZU is unique because we don't ask you to be a Revenue Manager. We combine AI technology with real Revenue Managers on our team. Our experts actively:

- Monitor your competitors daily

- Track local events and demand trends

- Adjust your prices in real-time to maximize RevPAR

- Optimize rate strategies across all channels

The Result: Our clients see average RevPAR increases of 12-18% in their first year—not because our software is magic, but because we provide the human expertise most independent hotels can't afford to hire.

Winner: ZUZU (if you want it done for you), Cloudbeds + external RMS (if you have in-house expertise)

4. Channel Management: Connectivity vs. Optimization

Getting your rooms on booking sites is critical—but connection alone isn't enough.

The Connectivity Champions (SiteMinder, Cloudbeds):

SiteMinder connects to 450+ channels[^4]—the most in the industry. If you need niche OTAs in Eastern Europe or South America, they're your best bet.

Cloudbeds connects to 400+ channels[^2], covering all major global OTAs plus regional players.

The Optimization Experts (ZUZU):

ZUZU connects to all major global and regional OTAs that drive 95% of bookings in Southeast Asia:

- Agoda

- Booking.com

- Expedia

- Traveloka

- Trip.com

- Plus regional leaders

The Difference: ZUZU goes beyond connection. We actively manage your:

- Content Score optimization (better photos, descriptions)

- Search ranking on OTA platforms

- Rate positioning vs. competitors

- Availability strategies to maximize revenue

Real Impact: Better OTA optimization can increase your property's click-through rate by 40-60%, directly boosting bookings.

Winner: SiteMinder (for maximum breadth), ZUZU (for managed optimization in Asia)

5. Direct Bookings: Widget vs. Strategy

Every hotel wants more direct bookings to avoid OTA commissions. But simply having a booking engine isn't enough.

The Widget Providers (Cloudbeds, Mews, Little Hotelier):

They give you a "Booking Engine" widget to embed on your website. It processes payments smoothly. But driving traffic to your website and converting visitors to bookers? That's 100% your responsibility.

Most hotels see only 5-15% of their bookings come direct—not because their booking engine is bad, but because they lack a comprehensive direct booking strategy.

The Conversion Strategists (ZUZU):

We provide the Booking Engine, but we also implement a complete Rate Parity Strategy:

- Ensure your direct rates are competitive vs. OTAs (not identical, but compelling)

- Optimize your website's booking flow for conversion

- Advise on marketing tactics to drive traffic

- Monitor rate parity violations

Average Result: Hotels working with ZUZU see direct bookings increase from 8-12% to 15-25% of total bookings within 12 months.

Winner: All platforms provide capable booking engines; ZUZU provides the strategy to make them effective.

6. Customer Reputation Management

Online reviews directly impact your booking conversion rate. A property with 8.5+ rating on Booking.com can charge 12-15% higher rates than a 7.5 rated competitor.

Separate Tools Approach (Oracle, Hotelogix, SiteMinder):

Reputation management is either an expensive add-on or requires third-party integration (like ReviewPro, which costs $100-300/month extra).

Integrated but Manual (Cloudbeds, Mews):

These platforms show you review scores and aggregate feedback, but responding and improving is still manual.

Integrated Advisory (ZUZU):

We view reviews as a revenue lever, not just a feedback system. Our team:

- Monitors review sentiment across all platforms

- Advises on operational improvements to address recurring complaints

- Helps craft professional responses to negative reviews

- Tracks how review score improvements impact conversion rates

The Impact: Improving from 8.0 to 8.6 average rating can increase your bookings by 10-15% at the same price point.

Winner: ZUZU (for managed approach), Cloudbeds (for integrated visibility)

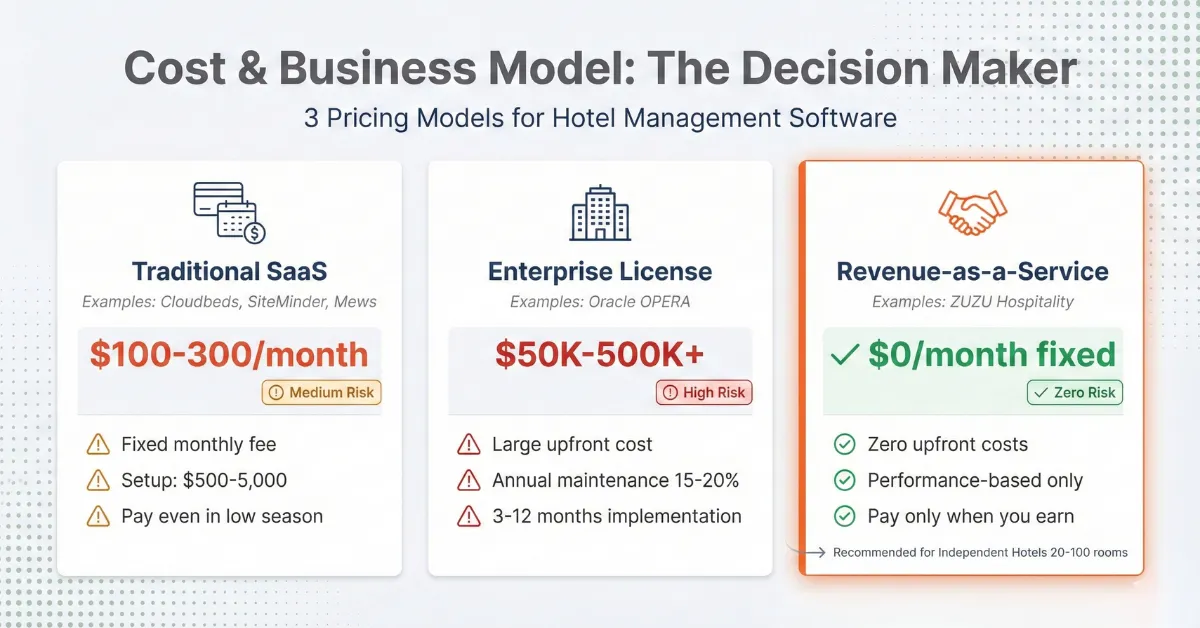

Cost & Business Model: The Decision Maker

This is the most important comparison for an independent hotelier's cash flow and risk management.

The Traditional SaaS Model (Cloudbeds, SiteMinder, Mews, Hotelogix)

Structure: Fixed Monthly Subscription

How it works:

- Pay $100-300+ per month regardless of performance

- Annual contracts are common

- Setup fees: $500-5,000

- Training fees: $500-2,000

- Premium features: Additional monthly costs

The Risk: You pay the same high fee every month whether your hotel is:

- At 90% occupancy (high season)

- At 30% occupancy (low season)

- Closed for renovations

- Impacted by economic downturns

Real Example: A 40-room independent hotel using Cloudbeds:

- Software: $1,800-2,400/year

- Setup: $1,000 one-time

- Training: $500

- Add-ons (revenue tools, advanced reports): $600-1,200/year

- Total Year 1 Cost: $3,900-5,100

- Ongoing Annual Cost: $2,400-3,600

The Challenge: During the pandemic, hotels still paid these fixed costs even when completely shut down. Fixed SaaS costs don't adjust to business reality.

The ZUZU Model: Revenue-as-a-Service (RaaS)

Structure: Performance-Based Partnership

How it works:

- Zero fixed monthly fees

- Zero setup costs

- Zero implementation fees

- We charge a small percentage of the incremental revenue we help you generate

The Benefit:

- If occupancy drops, your costs drop

- If you don't get bookings, we don't get paid

- Our incentives are perfectly aligned with yours

- We're motivated to work hard to fill your rooms

Real Example: Same 40-room hotel using ZUZU:

- Software cost: $0/month fixed

- Setup cost: $0

- Training cost: $0 (we provide it)

- Performance commission: Only paid on revenue generated through our services

- Low season (30% occupancy): You pay less

- High season (85% occupancy): You pay more, but you're earning more

Risk Profile: Zero risk. If ZUZU doesn't deliver results, you don't pay. It's that simple.

Enterprise Model (Oracle OPERA)

Structure: Large upfront license + annual maintenance

Cost Range:

- Implementation: $50,000-$500,000+

- Annual maintenance: 15-20% of license cost

- Training: $10,000-50,000

- Ongoing IT support: Dedicated staff required

Target: Only makes sense for 200+ room luxury properties and global chains.

The Hidden Costs of SaaS Hotel Software

Most hotel software companies advertise their "starting price" prominently. But the true cost of ownership includes many hidden expenses:

Typical Hidden Costs:

- ❌ Monthly subscription fees that don't adjust for seasonality or performance

- ❌ Setup & onboarding fees ($500-$5,000 depending on complexity)

- ❌ Training costs for initial staff + ongoing costs when staff turnover happens

- ❌ Add-on module fees for features that should be standard (advanced reporting, revenue tools, etc.)

- ❌ Integration costs with existing systems (accounting, POS, etc.)

- ❌ Support upgrade fees - many SaaS providers charge extra for phone support or priority assistance

- ❌ Hidden opportunity cost - The time your staff spends managing and troubleshooting the system instead of serving guests

Real Cost Breakdown Example:

50-Room Independent Hotel Using Traditional SaaS PMS:

| Cost Item | Annual Cost |

| Software subscription (Cloudbeds) | $2,400 |

| Setup fee (Year 1 only) | $1,000 |

| Training (initial + turnover) | $800 |

| Add-on modules (RMS, advanced reporting) | $1,200 |

| Staff time managing system (30 hrs/month × $25/hr) | $9,000 |

| OR Part-time Revenue Manager salary | $24,000 |

| Total Annual Cost (DIY management) | $13,400 |

| Total Annual Cost (with RM hire) | $29,400 |

Same Hotel Using ZUZU RaaS Model:

| Cost Item | Annual Cost |

| Fixed monthly fees | $0 |

| Setup fee | $0 |

| Training | $0 |

| Staff time managing system | $0 (ZUZU manages) |

| Revenue Manager salary | $0 (included) |

| Performance-based commission | Only on revenue generated |

| Total Fixed Cost | $0 |

The Math: Even if ZUZU's performance commission equals $15,000-20,000 annually, you're still saving money compared to the full-cost DIY approach—and getting better revenue optimization results.

Master Comparison Table

| Feature | ZUZU | Cloudbeds | SiteMinder | Oracle OPERA | Little Hotelier | Mews |

| Pricing Model | Performance-based (0% fixed) | Fixed subscription | Fixed subscription | Enterprise license | Fixed subscription | Fixed subscription |

| Starting Price | $0/month | ~$100-150/month | €56-85/month | Custom ($50K-500K+) | $50-80/month | Custom quote |

| Setup Cost | $0 | $500-2,000 | ~$500+ | $50K-500K+ | $300-800 | $2,000-5,000 |

| Implementation Time | 2-4 weeks | 4-8 weeks | 2-6 weeks | 3-12 months | 1-3 weeks | 6-12 weeks |

| Channel Connections | 400+ global And Major Asia OTAs (95% of bookings) | 400+ global | 450+ global | Via integrations | Via SiteMinder | 200+ |

| Revenue Management | Done-For-You (AI + Human Experts) | DIY tools included | DIY or 3rd party | Requires 3rd party RMS | Basic rules | DIY tools |

| PMS Usability | Streamlined for independents | Modern, intuitive | Basic (Little Hotelier) | Complex, enterprise | Very simple | Modern, advanced |

| Best For | Independent 20-100 rooms | Hostels, boutiques 10-50 rooms | Any size (connectivity focus) | Luxury chains 200+ rooms | B&Bs 5-20 rooms | Modern chains 30-200 rooms |

| Geographic Focus | Southeast Asia | Global | Global | Global | Global | Europe, Americas |

| Learning Curve | Minimal (managed for you) | Low-Medium | Medium | Very High | Very Low | Medium-High |

| Support Model | Dedicated RM team | Email, chat (phone extra) | Email, chat | Enterprise support | Email, chat | Email, chat |

| Contract Type | Performance-based (flexible) | Annual subscription | Monthly/Annual | Multi-year license | Monthly/Annual | Annual subscription |

Pricing data sourced from vendor websites, Hotel Tech Report, Capterra, SelectHub, and TrustRadius as of January 2026[^2][^3][^4][^5][^7]

Real-World Case Studies: SaaS vs. RaaS

Let's look at actual results from comparable independent hotels using different models.

Case Study A: Bangkok Boutique Hotel (45 rooms) - Using Cloudbeds DIY

Starting Situation:

- 45-room boutique property in central Bangkok

- Tech-savvy owner managing Cloudbeds himself

- No dedicated revenue manager

Annual Performance:

- Monthly software cost: $150

- Staff time managing system: 25-30 hours/month

- Annual RevPAR growth: +3% (self-managed pricing)

- Direct booking percentage: 11%

- Review score maintained: 8.2/10

Owner Feedback: "Cloudbeds is easy to use and I like having control, but I know I'm not optimizing pricing properly. I just don't have time to monitor competitors daily."

Case Study B: Pattaya Resort Hotel (52 rooms) - Using ZUZU RaaS

Starting Situation:

- 52-room beach resort in Pattaya

- Owner with limited technical background

- Previously using outdated on-premise PMS

After 12 Months with ZUZU:

- Monthly software cost: $0 fixed fee

- Staff time managing system: 0 hours (ZUZU manages everything)

- Annual RevPAR growth: +18%

- Direct booking percentage increased: 9% → 22%

- Review score improved: 7.9 → 8.5

- Performance fee paid only on incremental revenue

Owner Feedback: "I was skeptical about the revenue-sharing model, but ZUZU has increased my revenue so much that I'm happy to pay them their share. The best part is I don't have to think about rates anymore—they handle everything."

Case Study C: Chiang Mai Guesthouse (18 rooms) - Using Little Hotelier

Starting Situation:

- 18-room guesthouse in Chiang Mai Old City

- Elderly couple owners with minimal tech experience

- Need simplicity over advanced features

Performance:

- Monthly software cost: $65

- Very easy for owners to use

- Basic channel connectivity sufficient for their needs

- Limited growth optimization but stable operation

- Perfect fit for their simple requirements

Owner Feedback: "Little Hotelier is simple enough for us to manage. We don't need fancy features—just a reliable system that prevents double bookings."

The Pattern:

- Small properties (under 20 rooms) with simple needs: Little Hotelier, eviivo = Good fit

- Tech-savvy operators (30-60 rooms) who want control: Cloudbeds, Mews = Good fit

- Growth-focused independents (20-300 rooms) without RM staff: ZUZU RaaS = Best ROI

- Large chains/luxury (200+ rooms) with IT teams: Oracle OPERA = Necessary complexity

How to Choose: The Decision Framework

Use this decision tree to find your ideal solution:

Step 1: What's your property size?

Under 20 rooms (B&B, small guesthouse): → Consider: Little Hotelier, eviivo → Why: Simple, affordable, sufficient features

20-300 rooms (independent hotel, boutique): → Consider: ZUZU (if revenue growth focus), Cloudbeds (if DIY preference) → Why: Right balance of features and complexity

100-200 rooms (upscale independent, small chain): → Consider: Cloudbeds, Mews, RoomRaccoon → Why: Scalable platforms with advanced features

200+ rooms (luxury, large chain): → Consider: Oracle OPERA, Mews Enterprise → Why: Can handle complexity and scale

Step 2: Do you have dedicated IT/revenue management staff?

No in-house technical/RM expertise: → Best Choice: ZUZU (managed service model) → Alternative: Little Hotelier (if very small and simple needs)

Tech-savvy owner who wants to self-manage: → Best Choice: Cloudbeds (powerful DIY tools) → Alternative: Mews (if you want cutting-edge features)

Dedicated IT team and revenue manager: → Best Choice: Cloudbeds or Mews + standalone RMS → Enterprise: Oracle OPERA

Step 3: What's your risk tolerance for fixed costs?

Low risk tolerance (want costs to scale with revenue): → Only Option: ZUZU (performance-based pricing)

Comfortable with fixed monthly costs: → Any SaaS option (Cloudbeds, SiteMinder, Mews, etc.)

Large budget for upfront investment: → Oracle OPERA (enterprise)

Step 4: What's your primary geographic market?

Southeast Asia (Thailand, Vietnam, Indonesia, Malaysia): → Best Choice: ZUZU (regional expertise + multilingual support) → Alternative: Cloudbeds, Hotelogix

Global/Western markets: → Cloudbeds, SiteMinder, Mews

Australia/New Zealand: → RMS Cloud, Cloudbeds

Step 5: What's your #1 priority?

Revenue optimization & growth: → ZUZU (managed revenue strategy)

Maximum OTA connectivity: → SiteMinder (450+ channels)

Complete control & customization: → Cloudbeds or Mews (powerful DIY platforms)

Simplicity above all: → Little Hotelier (easiest to learn)

Enterprise-scale operations: → Oracle OPERA (handles anything)

The Verdict: Which Solution is Right for You?

Choose Oracle OPERA if:

You're a 200+ room luxury hotel with a dedicated IT department, complex conference operations, and enterprise budget ($50K+ implementation).

Choose SiteMinder if:

Your primary goal is maximum OTA connectivity (450+ channels) and you need the most stable, reliable channel management in the industry.

Choose Cloudbeds or Mews if:

You have tech-savvy staff or an in-house Revenue Manager who wants powerful DIY tools to control operations manually. Best for 30-100 room properties.

Choose Little Hotelier or eviivo if:

You're running a small B&B, guesthouse, or vacation rental under 20 rooms and need maximum simplicity.

Choose RoomRaccoon if:

You're a boutique hotel focused on maximizing ancillary revenue through automated guest upselling and marketing.

Choose ZUZU Hospitality if:

- ✅ You're an independent hotel (20-300 rooms) who wants to compete with big chains

- ✅ You don't have budget to hire a dedicated Revenue Manager

- ✅ You want a partner who shares the risk and only earns when you earn

- ✅ You want expert revenue management done for you, not DIY software

- ✅ You operate in Southeast Asia markets

- ✅ You want to focus on hospitality while we handle technology & optimization

Frequently Asked Questions

What is the cheapest hotel PMS for independent hotels?

Little Hotelier and eviivo offer entry-level pricing starting around $50-80/month for small properties under 20 rooms. However, ZUZU's performance-based model has zero fixed monthly fees—you only pay a commission on revenue generated through our services, making it the lowest-risk option financially.

Is Cloudbeds worth the price in 2026?

Yes—if you have the expertise to manage it properly. Cloudbeds pricing ($100-150/month starting) offers excellent value for tech-savvy hotel operators who can configure yield management, monitor competitors, and optimize channels themselves. However, independent hotels without dedicated revenue management staff often struggle to maximize ROI from the platform. In those cases, the software cost is low but the opportunity cost of suboptimal revenue management is high.

How much does SiteMinder cost per month?

SiteMinder channel manager pricing starts at €56-85 per month for basic channel management only[^5]. Additional fees apply for:

- PMS integration setup

- Booking engine (separate product)

- Multiple properties

- Advanced features and add-ons

Total costs typically range €100-200/month for a single independent hotel with full functionality.

What is Revenue-as-a-Service (RaaS)?

RaaS is a business model that combines software + services in a performance-based partnership. Instead of paying fixed monthly fees for software you must manage yourself, you get:

- Complete technology stack (PMS, Channel Manager, Booking Engine, RMS)

- Expert team (Revenue Managers who actively optimize your pricing)

- Zero fixed costs (no monthly fees, no setup charges)

- Pay only for results (commission only on revenue generated)

ZUZU pioneered this model for independent hotels in Southeast Asia. Our incentives are aligned with yours—we only succeed when you succeed.

How much does Oracle OPERA cost?

Oracle OPERA pricing is enterprise-level and not publicly disclosed[^7]. Based on industry reports and implementation partners:

- Setup/Implementation: $50,000 - $500,000+ (depending on property size and complexity)

- Annual Maintenance: 15-20% of license cost

- Training: $10,000 - $50,000

- Timeline: 3-12 months implementation

OPERA is designed for large hotel chains (200+ rooms), luxury resorts, and properties with dedicated IT departments. It's massive overkill—and financially impractical—for most independent hotels.

Can I switch from my current PMS to a new system?

Yes, all modern cloud-based PMS providers support data migration from legacy systems. Typical switching process:

- Data export from old system (reservations, guest profiles, rates)

- Data mapping & import to new system (1-2 weeks)

- Staff training (1-2 weeks)

- Parallel running (optional - run both systems simultaneously for 1-2 weeks)

- Go-live cutover (typically on a slow day/week)

ZUZU's Approach: We handle the entire migration for you at no additional cost. Our team manages data transfer, staff training, and ensures smooth transition with zero disruption to operations.

What's better: All-in-one PMS or best-of-breed integration?

For independent hotels under 100 rooms: All-in-one is almost always better.

All-in-One Advantages:

- Single login, unified interface

- Seamless data flow between modules

- One vendor relationship for support

- Lower total cost

- Faster implementation

Best-of-Breed Advantages:

- Choose "best" tool for each function

- More flexibility and customization

- Can replace individual components

The Problem with Best-of-Breed: Integration complexity, higher costs, multiple vendor relationships, and data synchronization issues. Only makes sense for large hotels (200+ rooms) with dedicated IT staff.

Do I need a separate Revenue Management System (RMS)?

It depends on your situation:

You DON'T need separate RMS if:

- You use ZUZU (revenue management included with human experts)

- You're under 20 rooms with simple pricing

- You manually manage rates and are satisfied with results

You SHOULD consider RMS if:

- You use Cloudbeds/Mews and have in-house revenue manager who can use it

- You're 50+ rooms with complex rate strategies

- You want AI-powered dynamic pricing recommendations

Popular RMS options: IDeaS, Duetto, Lighthouse, RaccoonRev Plus (if using RoomRaccoon)

Cost: $200-1,000+/month depending on property size and sophistication

What's the average ROI on hotel management software?

Industry research shows hotels implementing modern PMS + RMS typically see:

- 5-20% RevPAR increase within first year[^8]

- 20-40 hours/month saved on manual administrative work

- 10-15% increase in direct bookings (if using integrated booking engine well)

- Payback period: 6-18 months for SaaS investments

ZUZU's Performance-Based Model provides different ROI math:

- Zero upfront investment (nothing to "pay back")

- Average 12-18% RevPAR increase in year one

- Zero risk - you only pay when results are delivered

How important are online reviews for hotel bookings?

Extremely important. Research shows:

- Properties with 8.5+ rating can charge 12-15% higher rates than 7.5-rated competitors

- 89% of travelers read reviews before booking

- One-point improvement (e.g., 8.0 → 9.0) increases conversion by 10-15%

- Reviews on Booking.com and Google have highest impact on booking decisions

ZUZU's Approach: We monitor review sentiment across platforms and advise on operational improvements to boost scores—because better reviews = more bookings = more revenue for everyone.

What happens to my data if I cancel my PMS subscription?

Important to verify before signing:

- Cloudbeds, Mews, SiteMinder: You can typically export your data (guest profiles, reservations, financials) before canceling. Data export formats vary (CSV, XML, API).

- Oracle OPERA: Enterprise contracts usually include data retention terms; verify in your agreement.

- ZUZU: You retain full ownership of your data. We provide complete export in standard formats if you ever choose to switch providers. No data hostage situations.

Pro Tip: Before signing with ANY PMS, ask: "What data export options do I have if I cancel? What format? Is there a fee?"

Is cloud-based PMS secure?

Yes, when done properly. Modern cloud PMS providers typically offer:

- Enterprise-grade encryption (data in transit and at rest)

- PCI-DSS compliance for payment card data

- Regular security audits and penetration testing

- Automatic backups (often hourly)

- Redundant data centers for disaster recovery

Cloud is often MORE secure than on-premise because:

- Professional security teams manage infrastructure 24/7

- Automatic security patches and updates

- No risk of local server theft/damage

- Better disaster recovery capabilities

Due Diligence: Ask any vendor about their security certifications (ISO 27001, SOC 2, PCI-DSS) and data backup procedures.

Take Action: Find Your Perfect PMS Solution

The hotel software market in 2026 offers more choices than ever—but more options don't make decisions easier.

Here's what you need to remember:

- SaaS model (Cloudbeds, SiteMinder, Mews) = Great if you have expertise to manage it

- Enterprise (Oracle OPERA) = Only for large chains with big budgets

- Simple tools (Little Hotelier) = Perfect for very small properties

- RaaS model (ZUZU) = Best risk-reward for growth-focused independent hotels

The fundamental question:

Do you want to buy software you must manage yourself? Or hire a partner who manages it for you and shares your risk?

Don't Just Buy Software. Hire a Partner.

If you're an independent hotel owner in Southeast Asia who wants to:

- ✅ Compete with big chains without big-chain costs

- ✅ Eliminate fixed software fees and pay only for results

- ✅ Optimize revenue without hiring a Revenue Manager

- ✅ Focus on hospitality while experts handle technology

ZUZU is built for you.

See How Much Revenue You're Leaving on the Table

Get a complimentary competitive analysis of your property:

✓ Current pricing analysis vs. optimal market rates

✓ Lost revenue opportunities identified

✓ Custom RaaS proposal with zero commitment

Average audit reveals $47,000 in missed annual revenue opportunity.

→ Get Your Free Revenue Audit (Takes 2 minutes)

References

[1] Global Hotel & Hospitality Management Software Market Report 2026-2032. GlobeNewswire, January 2026. https://www.globenewswire.com/news-release/2026/01/19/3220768/28124/en/Hotel-Hospitality-Management-Software-Markets-and-Competitive-Landscape-Analysis-2026-2032.html

[2] Cloudbeds Product Information & Reviews. Hotel Tech Report, 2026. Multiple sources verify 400+ channel connections and Hotel Tech Report Top PMS ranking 2021-2025.

[3] Cloudbeds Pricing Analysis. SelectHub, 2026. https://www.selecthub.com/hotel-property-management-systems/cloudbeds/ and SaaSworthy Pricing data (Updated October 2025).

[4] SiteMinder #1 Channel Manager, 2026 HotelTechAwards. Hotel Tech Report. https://hoteltechreport.com/revenue-management/channel-managers/siteminder-channel-manager

[5] SiteMinder Pricing Information. HotelMinder, April 2025. https://www.hotelminder.com/partner=SiteMinder - Starting at €56/month for channel manager only.

[6] Oracle OPERA Cloud Selected by Major Chains (Hyatt, Accor, Rotana). Hotel News Resource, September 2025. https://www.hotelnewsresource.com/article137933.html

[7] Oracle OPERA Pricing Analysis. TrustRadius, 2026. https://www.trustradius.com/products/oracle-hospitality-opera/pricing - Custom pricing, not publicly disclosed; industry estimates $50K-500K+ implementation.

[8] Revenue Management System ROI Statistics. Hotel Tech Report: Top 10 Revenue Management Systems 2026. https://hoteltechreport.com/revenue-management/revenue-management-systems - Hotels typically see 5-20% RevPAR increase and save 20-40 hours monthly.